Yield farming, since the explosion of Decentralized Finance (DeFi) in the summer of 2020, has been an immensely popular activity for cryptocurrency holders. DeFi Pulse showed that in March 2020, the total value locked in DeFi protocols was around 600 million USD. Apart from the non-custodial aspect, researchers stated the permissionless nature and the openly auditable protocols, the main driver for the growth of this industry is the composability of financial services. The so-called “DeFi Stack” or “Money Legos” allow protocols to build and combine functionalities, without the need of having this expertise in-house.

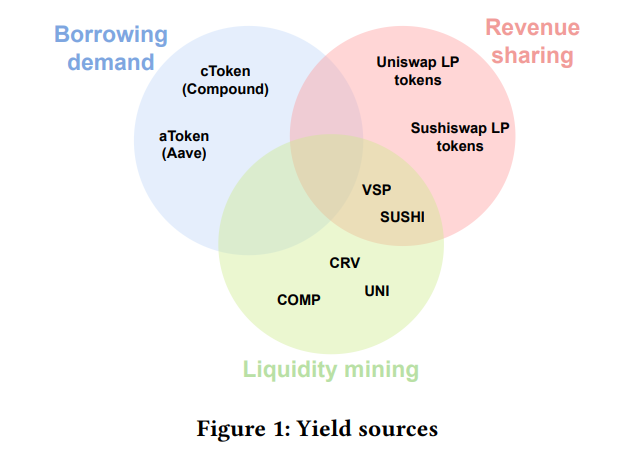

Yield farming is one of the applications that has come from the above-described movement, where investors passively earn yield by transferring tokens to a wide range of yield generating smart contracts. Yield, defined by Cambridge English Dictionary, means “the total amount of profit or income produced from a business or investment”, is often measured in terms of Annual Percentage Yield (APY). Yield is the ultimate goal pursued by farmers and typically originates from borrowing demand, liquidity mining, as well as revenue sharing.

Source: Cousaert, S., Xu, J., & Matsui, T. (2021). SoK: Yield Aggregators in DeFi. arXiv preprint arXiv:2105.13891.

Additionally, yield farming is also known as liquidity mining, permits farmers to contribute their stores in a mining pool that will gain them liberal benefits as the venture creates. It is near to staking, but yield farming goes around shopping from market to advertise to explore for the more profitable offerings.

Yield farming relies on other building blocks in the DeFi stack that pragmatically use protocols for loanable funds (PLF), Automated Market Makers (AMM), and liquidity incentivizing protocol as the essential type of protocols within the yield farming that define the mechanisms behind the concept. Token in yields farming generally follow a standard token interface, representing assets, synthetic assets, or derivatives. And stablecoins, PLF interest-bearing tokens, AMM liquidity provider (LP) tokens, native/governance tokens were the most important tokens in yield farming.

With tools provided in yield farming as aforementioned, this leads us to the benefits of yield farming. Yield farming rewards users for providing digital assets to the liquidity pool or providing other value-added services to a decentralized application’s ecosystem. The crypto owner will earn incredibly attractive returns on their cryptocurrency, at least a hundred times higher than a traditional bank would offer. The money used to pay the yield farmers comprises trading fees within a decentralized exchange and interest from the lending money market. Yield farming also offers higher returns than most other traditional investment channels, from real estate to stocks and bonds.

On the other hand, as the benefit of yield farming is sweet, sweet profit, the risk involved also needs to be aware of. DeFi applications are open source and can be vulnerable to hacks, interest rates also can be volatile, making it hard to predict what your rewards could look like over the coming year–this occurs when there is a drop in the value of the coin they have used as collateral, which can trigger a loss of all the yield farmer’s capital.

Basically, to get the full potential of yield farming, users need to mitigate risk wherever possible as the only best approach. The volatility and fast-paced growth of yield farming make it hard to predict the future. But, for now, high-risk, high-reward yield farming is worth pursuing after in depth necessary research and risk assessment in advance.