After running for more than 10 years, blockchain technology is still inseparable from a cryptographic technology called crypto currency. This is what makes an exchange both centralized and decentralized still an important element of blockchain and cryptocurrency.

But unfortunately, until now there are still many people who find it difficult to distinguish between centralized and decentralized exchange. Let’s discuss the differences, as well as the advantages and disadvantages of these two types of cryptocurrency exchange.

Table of Contents

Centralized Exchange (CEX)

A centralized exchange is perhaps the most popular type of cryptocurrency exchange and is known by almost everyone who has plunged deeper into the world of cryptocurrency. A centralized exchange is a cryptocurrency exchange/trading platform arranged by a central organization company to provide a meeting place for people who want to exchange cryptocurrency.

Usually, a centralized exchange offers a cryptocurrency exchange from fiat-cryptocurrency or cryptocurrency-cryptocurrency. In accordance with its name “centralized” which means there is a central organization company that acts as a third person to store user assets, set exchange rules, and charge exchange fees.

Example: Indodax, Binance, and OKEx

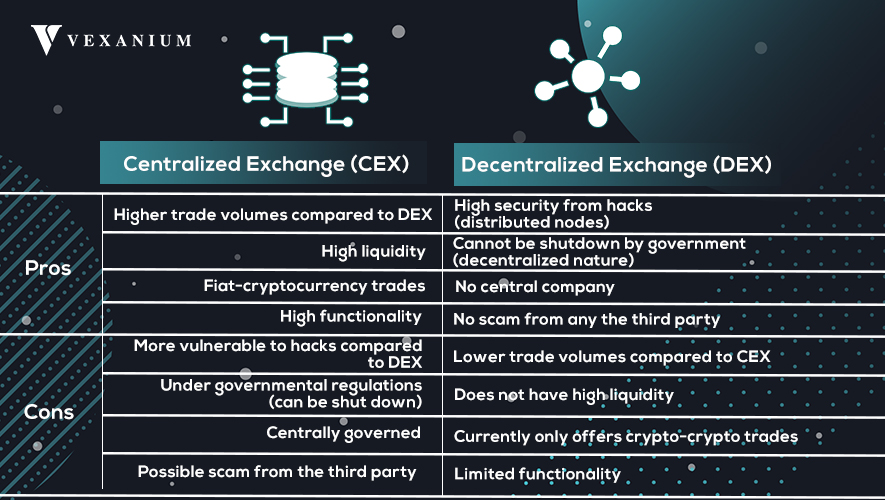

Advantages

- Trading volume is higher compared to DEX

- High liquidity

- Fiat-cryptocurrency trading

- High functionality

Disadvantages

- More vulnerable to hacking compared to DEX

- Under government regulations (can be closed)

- Arranged centrally

- Possible scam from a third party

Decentralized Exchange (DEX)

Meanwhile, decentralized exchange is an evolution of centralized exchange that has fully adopted the concept of the blockchain, namely decentralization. This type of exchange does not depend on companies or services to control the assets of users. Conversely, trading or transactions are controlled by automated processes that are carried out with smart contracts. This trade is said to be peer-to-peer or users.

Using blockchain technology, decentralized exchanges are built to ensure there is a safe way to do cryptocurrency exchanges without the need for third-party assistance. Basically, the platform acts as a service that connects trading orders with each other to serve customers who want to exchange cryptocurrency (coins or tokens).

Example: Poloni Dex (TRON), Newdex (EOS and TRON), Switcheo Network (Ethereum, NEO, and EOS), Basicdex (Vexanium)

Read more: What is Vexanium? – The Complete Guide to Understand Vexanium Blockchain 101

Advantages

- High security from hacks (distributed nodes)

- Cannot be closed by the government (decentralized nature)

- There is no central company

- There is no fraud from any third party

Disadvantages

- Trading volume is lower compared to CEX

- Do not have high liquidity

- Currently only offers crypto-crypto trading

- Limited functionality

Conclusion

So the conclusion is that although it has the same function, namely for cryptocurrency exchange, the two types of cryptocurrency exchange have a very significant difference. Centralized exchanges are still regulated by certain entities (third party), while decentralized exchanges are already running automatically with smart contract technology from the blockchain. After seeing the advantages and disadvantages of both, then we can find out which exchange we want to use.