Not only has it become the center of attention among investors, but the acceptance of cryptocurrencies is also increasingly widespread among the general public. The massive use of crypto assets and digital payment systems has increased rapidly since the Covid-19 pandemic. It has become the basis for central banks in various countries to formulate Central Bank Digital Currency (CBDC) or digital currency. The CBDC exchange rate will adjust to the exchange rate in the country concerned.

Although the issue of CBDCs has attracted global attention, there are still very few countries that publish it. Based on a survey by the International Monetary Fund (IMF) shows that most countries in the Asia region have shown interest in CBDCs by starting to conduct research, initial development, and launching direct trials.

So what exactly is a Central Bank Digital Currency (CBDC), and how are CBDCs different from cryptocurrencies?

Table of Contents

Definition of Central Bank Digital Currency (CBDC)

Digital currency is a digital version of the official currency issued by the government. CBDCs are issued and regulated by a country’s central bank and use blockchain technology to speed up and increase the security of digital transaction processes. Not all CBDCs use blockchain technology, for example, e-CNY (China’s CBDC). Unlike Bitcoin and other cryptocurrencies, e-CNY does not operate via a blockchain-based decentralized ledger.

Definition of Cryptocurrency

Cryptocurrency is a digital asset designed as a medium of exchange using cryptography to secure financial transactions without going through a third party. The most famous cryptocurrency is Bitcoin. Apart from Bitcoin, there are thousands of cryptocurrencies, one of which is Vexanium Coin (VEX Coin).

Benefits of Central Bank Digital Currency (CBDC)

Expanding Access to Finance

Digital currencies can connect customers and central banks directly as they are distributed on mobile devices. CBDC can also be a solution for people who are far from bank branches and cannot access cash.

Free from Liquidity and Credit Risk

CBDC eliminates third-party risk from events such as a banking crisis or collapse.

Improving Monetary Policy

The CBDC gives the central bank direct influence over the money supply, thereby increasing control over transactions for tax control.

Risk of Central Bank Digital Currency (CBDC)

Changes in Financial Structure

The financial system can undergo significant transformations. It is still being determined what effect these changes have. It might affect consumer spending, investment, the financial services industry, interest rates, bank reserves, or the economy as a whole.

Financial System Stability

Regarding financial system stability, the impact of switching to CBDC is still uncertain. In a financial crisis, for example, there may not be enough central bank liquidity to support withdrawals.

Cyber Security

Weak banking security controls are subject to cyber-attacks. The same types of thieves may flock to central banks issuing digital money. So great efforts must be made to thwart system infiltration and theft of assets or information.

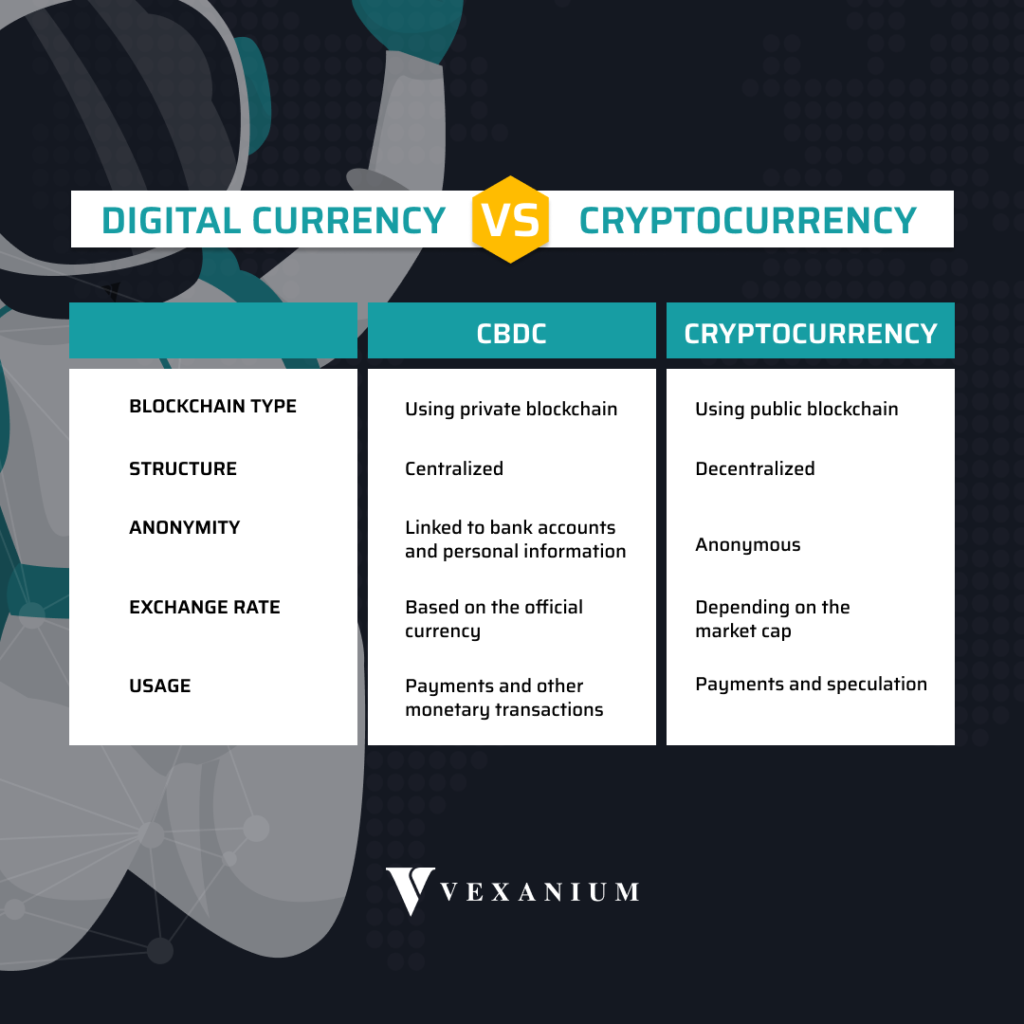

Difference between CBDC and Cryptocurrency

The first thing to remember about CBDC is that it is not a cryptocurrency. CBDCs are fully regulated by a central authority or bank instead of decentralized like cryptocurrencies. As we know, the ownership and authority of crypto can be entirely in the hands of its users, unlike CBDC.

CBDC acts as a digital version of fiat money, where personal details and transactions will be attached to the CBDC assets of its users. However, transaction details will only be available to the sender, recipient, and bank. It is what makes CBDC different from crypto. As we know, crypto transaction details are publicly available, but without disclosing personal data, such as users’ real names.

CBDC and cryptocurrencies have different values. CBDC is used as a means of payment and is operated by a central bank. It means that specific financial institutions can only access their blockchain network with the necessary privileges. Meanwhile, cryptocurrency is a decentralized digital asset hosted by a public blockchain network and can be accessed by anyone.

A user can use cryptocurrency for digital payments and transactions. You can see there is no central authority that can restrict use. Here is a comparison between CBDC and cryptocurrencies:

Which one is better?

Central Bank Digital Currency (CBDC) is the digital version of the official currency issued by the government and is centralized, where powerful entities rule. In contrast to crypto, which is decentralized, there is no central authority control. Both have their advantages and disadvantages.