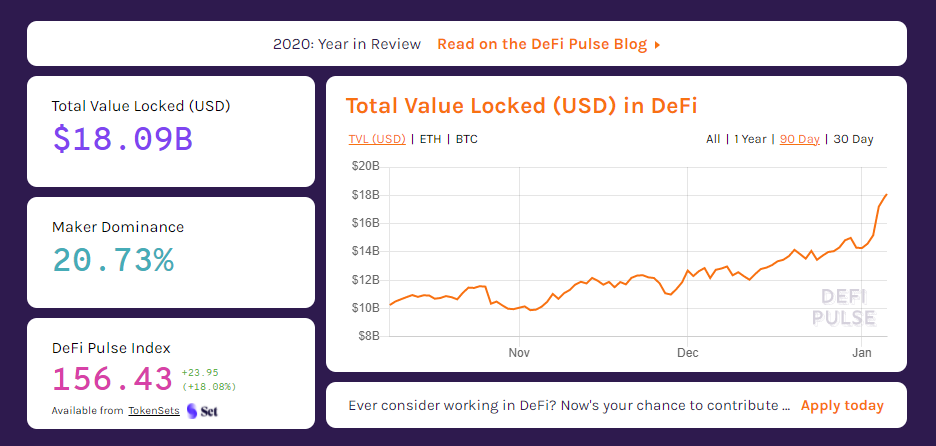

Decentralized Finance (DeFi) is bringing a breath of fresh air to the crypto world with products and features covering it since July 2017. And yield farming, which is the newest feature, is one of them. In mid-2020, reported by Coin Market Cap, yield farming became a hot issue that was the most talked about thanks to its further innovation, namely liquidity mining. That same year, yield farming helped boost the DeFi sector from a $500 million market cap to $10 billion. In another report, over the last year excessive growth in the DeFi economy reached a current total locked value at $18.09B.

Source: https://defipulse.com/

The driving force behind DeFi is the need for transparency and an open financial system. Exploding in 2020 with new coins such as UMA and COMP, allowing users to use traditional services such as savings and loans (giving rise to yield farming) in a decentralized ecosystem. There are three main differences between decentralized and traditional or centralized finance, namely:

- A decentralized financial model, the public blockchain acts as a source of trust to manage all sectors of the operation. Centralized finance, government, and banks act as sources of trust and manage operations.

- DeFi is open-source and allows anyone to log in with programming skills to build applications on the public blockchain. Banks, however, are reluctant to highlight their internal operations to the general public.

- Encouraging developers to build their own applications is also part of the innovations that DeFi offers; on the other hand, the centralized model is usually self-contained by a regulatory barrier.

Mutual trust and privacy are the gold points for decentralized finance than centralized finance. There is still a possibility that if regulations continue to develop their innovations, there will no longer be a place for a third person in the financial industry. Vexanium has decentralized finance in its blockchain technology. This technology is an open supply protocol, so users can produce and issue their own digital assets. Users can build loan protocols, investments, market predictions, exchanges, and stable coins.

So —

What is Yield Farming?

Basically, yield farming is the practice of saving and borrowing crypto assets to generate high yields. Or generate crypto assets with the crypto assets you have. With yield farming, maximizing a rate of return on capital by leveraging different DeFi protocols set as the goal. People who carry out this strategy are usually referred to as liquidity providers (LP). LP stakes or locks up their crypto assets in a smart contract-based liquidity pool by incentivizing a yield farming protocol.

These returns are expressed as an annual percentage yield (APY). The value of the issued returns also rise as investors add more funds to the related liquidity pool. A blockchain consultant, Maya Zehavi, once said, “farming opens up new price arbs [arbitrage] that can spill over to other protocols whose tokens are in the pool”.

Liquidity mining occurs when a yield farming participant earns token rewards as additional compensation, and came to prominence after Compound started issuing the skyrocketing COMP, its governance token, to its platform users. This means that anyone can try this strategy to lend their crypto assets for passive income. Most current yield farming protocols reward LP with governance tokens, which can usually be exchanged on centralized exchanges such as Binance and decentralized exchanges such as Uniswap.

Compared to trading crypto assets, this strategy is actually easier for anyone to understand and do. With the right strategy, yield farming is a safer alternative for beginners in the crypto world.

How Yield Farming Work?

In general, the yield farming method uses the DeFi application and gets tokens, you have to lock crypto assets into a smart contract. Yield Farming uses an automated market maker (AMM) and involves Liquidity Pools. Liquidity Providers act as owners of crypto assets that store their funds in the Liquidity Pools. Which means, liquidity pools have a role as a container or market when users borrow their assets, borrow from other users, or simply exchange assets in ERC-20 tokens.

Members will be charged a certain fee, this fee will be paid to the liquidity provider in accordance with the portion they give to the Liquidity Pools. Usually these funds are stored in the form of stablecoins pegged to USD such as DAI, USDT, USDC, BUSD and others. Some protocols usually print their own tokens which will later be stored in the system. For example, such as the Compound protocol which has a token in the form of COMP.

Source: https://blockchainsimplified.com/blog/the-yield-farming-phenomenon-lending-crypto-to-earn-interest/

Yields Farming Protocols

To optimize the returns on their staked funds, yield farmers will use a variety of different DeFi platforms often. These platforms offer variations of incentivized lending and borrowing from liquidity pools. Yield farming protocols that commonly use are listed —number 1-7 listed by Coin Market Cap— below:

- Compound is a money market for lending and borrowing assets, where algorithmically adjusted compound interest as well the governance token COMP can be earned.

- MakerDAO is a decentralized credit pioneer that lets users lock crypto as collateral assets to borrow DAI, a USD-pegged stablecoin. Interest is paid in the form of a “stability fee.”

- Aave is a decentralized lending and borrowing protocol to create money markets, where users can borrow assets and earn compound interest for lending in the form of the AAVE (previously LEND) token. Aave is also known for facilitating flash loans and credit delegation, where loans can be issued to borrowers without collateral.

- Uniswap is a hugely popular decentralized exchange (DEX) and automated market maker (AMM) that enables users to swap almost any ERC20 token pair without intermediaries. Liquidity providers must stake both sides of the liquidity pool in a 50/50 ratio, and in return earn a proportion of transaction fees as well as the UNI governance token.

- Balancer is a liquidity protocol that distinguishes itself through flexible staking. It doesn’t require lenders to add liquidity equally to both pools. Instead, liquidity providers can create customized liquidity pools with varying token ratios.

- Synthetix is a derivatives liquidity protocol that allows users to create synthetic crypto assets through the use of oracles for almost any traditional finance asset that can deliver reliable pricing data.

- Yearn.finance is an automated decentralized aggregation protocol that allows yield farmers to use various lending protocols like Aave and Compound for the highest yield. Yearn.finance algorithmically seeks the most profitable yield farming services and uses rebasing to maximize their profit.

- Baso.finance is the first yield farming (yield optimizer DeFi ecosystem) on Vexanium blockchain. BASO is issued in the form of YFI: no founders, no investors, no inflations, and all people are equal. The development team behind BASO aims to improve the Vexanium DeFi ecological infrastructure and stimulate the profitability of the entire VEX ecosystem.

- Batik.finance, same goes with BASO, BATIK also developed on Vexanium blockchain. So, the general purpose of this protocol is the same as B